What that means in a moment…

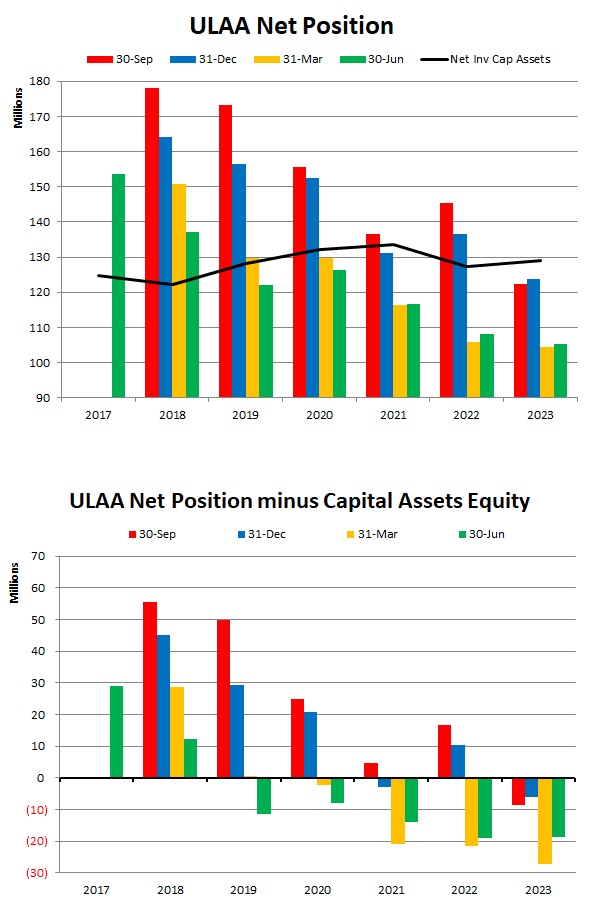

I updated a chart in this thread with the March 31 ULAA financial results. Here are the data showing the rolling change in ULAA net position. It uses a 24-month moving average (MA), and the data points are annualized. That is, the 24-mo MA for each is divided by two.

Change in net position for a time period is calculated as revenues minus expenses. It’s the closest gauge of “profit” for a non-profit entity. In U of L’s case, revenues are uneven over the year, so you have to focus on 12-month or year-over-year changes.

To get the quickest read on a change in trend, you want to simply examine data points with no smoothing, no MAs. However, unsmoothed 12-month numbers show a lot of variability, so I’m using a two year MA. That means you might have to wait a little longer to spot a trend.

Since the above plot is a DECLINE in net position, lower values are better. The average of all the values on this chart continues to run slightly over $8 million annually, that is, an $8 million average decline. The data points since Josh Heird took over average $8.3 million, and his last four average $6.5 million. This could be a slight trend in the right direction, and it could simply mean we are bottoming out.

So what’s “living in the red zone” about? Net position is declining consistently, but it’s still positive. We’re solvent, but we’re not very liquid. You see that vividly when you look at cash, a parameter we can all relate to.

Here’s a progression of ULAA cash balances on the last seven balance statements I have on file. Tyra called this “working capital,” and it’s probably close to what you or I would think of as a checking account balance. Josh Heird arrived in December 2021, so these are all his numbers…

I don’t have a full set of monthly values because I don’t ask for them, and you don’t really need them for this discussion. ULAA has operated for much of the last year with a significantly negative cash balance. I can locate ONE negative cash balance on prior financial reports dating back almost twenty years, and that one was recent as well (2021).

I was told by U of L when these values first turned negative that it was temporary, a “timing issue.” That’s obviously not true. Athletics is in serious financial straits and probably attempts to mask the problem. They certainly aren’t talking about this situation proactively. Instead, ULAA has turned balance sheet cash into something of an abstraction.

Anyone here who operates a large business can comment… Ours is not a situation of little or no cash; how would you run your business with a large negative bank balance? In my opinion, there must be some additional source of funding that’s disguised or absent from the balance sheet. The losses are apparent in ULAA’s equity or net position as I discussed above, but I can’t explain how you operate with a bank account that’s usually underwater millions of dollars…

I updated a chart in this thread with the March 31 ULAA financial results. Here are the data showing the rolling change in ULAA net position. It uses a 24-month moving average (MA), and the data points are annualized. That is, the 24-mo MA for each is divided by two.

Change in net position for a time period is calculated as revenues minus expenses. It’s the closest gauge of “profit” for a non-profit entity. In U of L’s case, revenues are uneven over the year, so you have to focus on 12-month or year-over-year changes.

To get the quickest read on a change in trend, you want to simply examine data points with no smoothing, no MAs. However, unsmoothed 12-month numbers show a lot of variability, so I’m using a two year MA. That means you might have to wait a little longer to spot a trend.

Since the above plot is a DECLINE in net position, lower values are better. The average of all the values on this chart continues to run slightly over $8 million annually, that is, an $8 million average decline. The data points since Josh Heird took over average $8.3 million, and his last four average $6.5 million. This could be a slight trend in the right direction, and it could simply mean we are bottoming out.

So what’s “living in the red zone” about? Net position is declining consistently, but it’s still positive. We’re solvent, but we’re not very liquid. You see that vividly when you look at cash, a parameter we can all relate to.

Here’s a progression of ULAA cash balances on the last seven balance statements I have on file. Tyra called this “working capital,” and it’s probably close to what you or I would think of as a checking account balance. Josh Heird arrived in December 2021, so these are all his numbers…

3/31/2022: (4,939,633)

5/31/2022: (6,103,915)

6/30/2022: 10,322,000 - Annual Report

7/31/2022: (18,161,390)

9/30/2022: (71,041)

12/31/2022: 4,728,609

3/31/2023: (12,482,079)

I don’t have a full set of monthly values because I don’t ask for them, and you don’t really need them for this discussion. ULAA has operated for much of the last year with a significantly negative cash balance. I can locate ONE negative cash balance on prior financial reports dating back almost twenty years, and that one was recent as well (2021).

I was told by U of L when these values first turned negative that it was temporary, a “timing issue.” That’s obviously not true. Athletics is in serious financial straits and probably attempts to mask the problem. They certainly aren’t talking about this situation proactively. Instead, ULAA has turned balance sheet cash into something of an abstraction.

Anyone here who operates a large business can comment… Ours is not a situation of little or no cash; how would you run your business with a large negative bank balance? In my opinion, there must be some additional source of funding that’s disguised or absent from the balance sheet. The losses are apparent in ULAA’s equity or net position as I discussed above, but I can’t explain how you operate with a bank account that’s usually underwater millions of dollars…

Last edited: