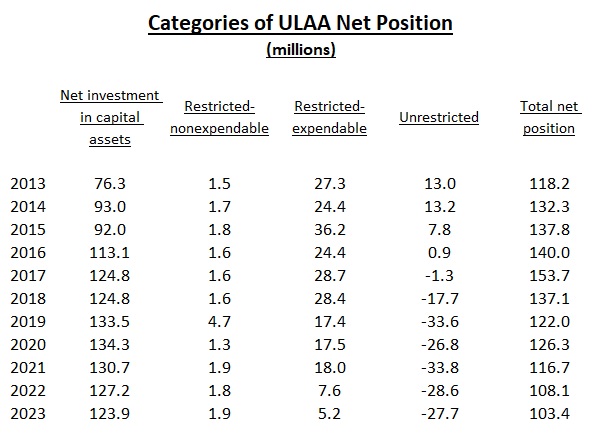

The ULAA balance sheet presents four components of net position that each tell their own story. The following descriptions are taken directly from the 2023 Annual Report for the components of net position…

We talk a lot about the far right column--the total--but it helps to know where ULAA's equity is and is not.

The "nonexpendable" column is small and relatively constant. My understanding is that $2 million or so is the principal part of ULAA's endowments. We get to spend the interest from those funds for specific purposes, but the principal remains mostly intact. Presumably as income accrues, it becomes expendable and no longer shows up as a balance in this category. So far all intents and purposes, this small amount of money is permanently unavailable to meet ULAA's cash needs.

The remaining categories hold assets that ARE available; the biggest issue is liquidity.

The first column is most of ULAA's equity that's positive, but it's entirely fixed assets that would have to be liquidated for cash. Large assets like the golf course and the football stadium. as well as small stuff like vehicles and equipment. These assets are typically shown at book value, their original cost less depreciation. My opinion is their value in total is overstated on this basis, primarily because the largest one--the football stadium--is not of great value to anyone but U of L. If U of L no longer needed it for football, the structures would have limited or no value. The underlying land which represented an environmental issue 30 years ago is where most of the value is assuming the environmental stuff doesn't "resurface." A couple hundred acres of development land east of Louisville currently occupied by the golf course obviously has value.

The "expendable" and "unrestricted" columns are where U of L would ordinarily go for available cash. And combined, they had -$22.5 million equity as of June 30, 2023. That is how much more in liabilities we have against liquid assets than the value of the assets themselves. In essence, we've emptied the cash piggybank and gone way beyond that point. The only way this huge negative balance can be explained is as money owed back to the University. It's also important to note that ULAA is keeping track of it. In other words, the University hasn't simply given that money to athletics, at least not yet.

So, ULAA is not bankrupt, but it's extremely illiquid. There is no available cash for anything large and unforeseen. It's pretty clear we're not doing much in the way of capital projects or building anything, nor should we. We can't afford it. And while U of L shows "gifts" on its income statement, any money of consequence that comes ULAA's way for a specific purpose is apparently accounted for as more debt, and not as a gift.

If anyone else has a different take, I'm interested in hearing it...

- Net investment in capital assets primarily represents capital assets and right-to-use assets, net of accumulated depreciation and amortization and reduced by the outstanding balances of borrowings used to finance the purchase or construction of those assets.

- Restricted nonexpendable net position consists of endowment gifts with specific restrictions. These endowments were made by donors to support scholarship expenses.

- Restricted expendable net position consists of noncapital assets that must be used for a particular purpose as specified by creditors, granters or donors external to the Association. The Association’s most significant as specified by creditors, granters or donors external to the Association. The Association’s most significant gifts with donor stipulations.

- Unrestricted net position represents those balances from operational activities that have not been restricted by parties external to the Association, such as donors. Although unrestricted net position is not subject to externally imposed stipulations, substantially all of the Association’s unrestricted net position has been designated for various sport, academic programs, or capital projects.

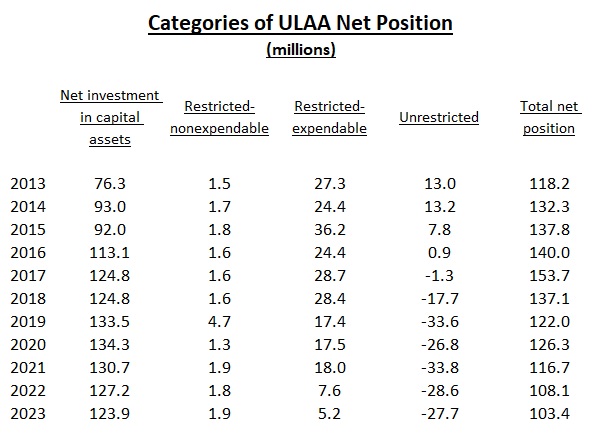

We talk a lot about the far right column--the total--but it helps to know where ULAA's equity is and is not.

The "nonexpendable" column is small and relatively constant. My understanding is that $2 million or so is the principal part of ULAA's endowments. We get to spend the interest from those funds for specific purposes, but the principal remains mostly intact. Presumably as income accrues, it becomes expendable and no longer shows up as a balance in this category. So far all intents and purposes, this small amount of money is permanently unavailable to meet ULAA's cash needs.

The remaining categories hold assets that ARE available; the biggest issue is liquidity.

The first column is most of ULAA's equity that's positive, but it's entirely fixed assets that would have to be liquidated for cash. Large assets like the golf course and the football stadium. as well as small stuff like vehicles and equipment. These assets are typically shown at book value, their original cost less depreciation. My opinion is their value in total is overstated on this basis, primarily because the largest one--the football stadium--is not of great value to anyone but U of L. If U of L no longer needed it for football, the structures would have limited or no value. The underlying land which represented an environmental issue 30 years ago is where most of the value is assuming the environmental stuff doesn't "resurface." A couple hundred acres of development land east of Louisville currently occupied by the golf course obviously has value.

The "expendable" and "unrestricted" columns are where U of L would ordinarily go for available cash. And combined, they had -$22.5 million equity as of June 30, 2023. That is how much more in liabilities we have against liquid assets than the value of the assets themselves. In essence, we've emptied the cash piggybank and gone way beyond that point. The only way this huge negative balance can be explained is as money owed back to the University. It's also important to note that ULAA is keeping track of it. In other words, the University hasn't simply given that money to athletics, at least not yet.

So, ULAA is not bankrupt, but it's extremely illiquid. There is no available cash for anything large and unforeseen. It's pretty clear we're not doing much in the way of capital projects or building anything, nor should we. We can't afford it. And while U of L shows "gifts" on its income statement, any money of consequence that comes ULAA's way for a specific purpose is apparently accounted for as more debt, and not as a gift.

If anyone else has a different take, I'm interested in hearing it...

Last edited: