After a short delay, the LAA posted their calendar year 2021 financials for the arena. I haven’t reported on their financials for a couple years since Covid made last year’s numbers difficult to analyze as far as performance.

Late in 2020, the LAA informed that Covid would significantly impair TIF revenue for 2021. The major financial impact actually occurred in 2020, but the TIF is paid to the LAA in the year following the tax relevant activity. So 2021 financials show a significant decline in TIF revenue from 2020.

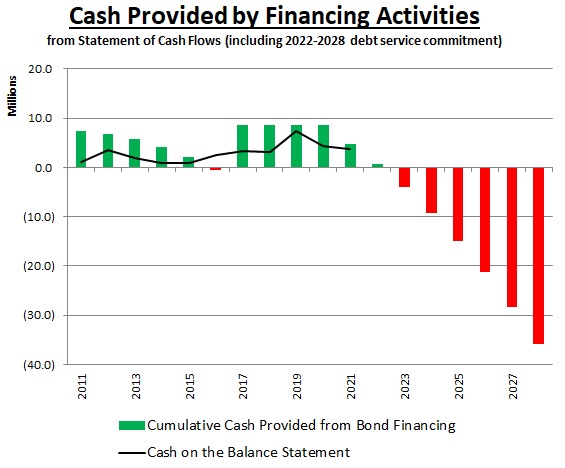

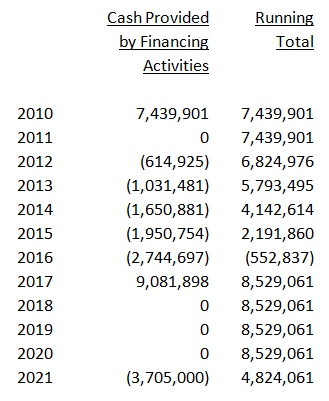

I’ll first present arena revenue information followed by a forward-looking analysis of the LAA’s cash position and debt service. Future requirements from the 2017-2018 bond refinancing are spelled out in a schedule of payments much like you have with a mortgage amortization schedule. There isn’t any guesswork or estimation involved. So let’s proceed…

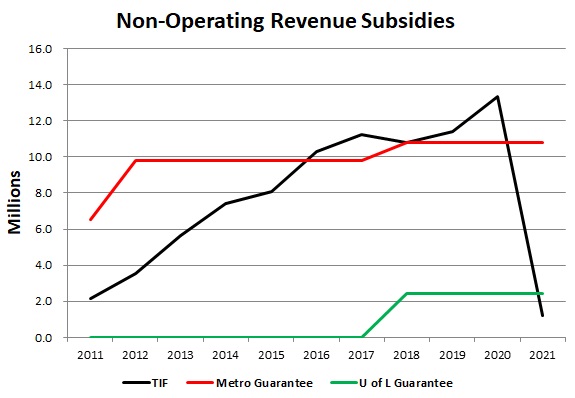

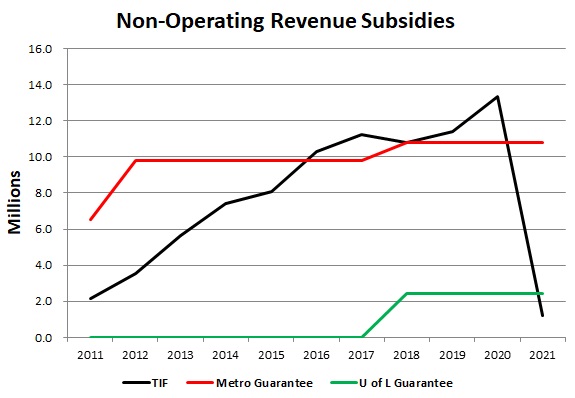

The majority of arena revenues in 2021 are NOT from true operating sources, “operating” in the sense of controllable or fluctuating. I used to and still occasionally refer to the place as “Bailout Arena” for this very reason. The arena was never self supporting even when it first opened its doors in late 2010. The City through its “Metro Guarantee” now contributes almost $11 million annually to arena operations. As we all recall since it happened more recently, the arena negotiated--extorted--$2.4 million annually from U of L starting in 2018 which the LAA accountants call the “U of L Guarantee.” And the TIF, of course, has been a significant and increasing revenue source until 2021’s Covid hiccup. Here’s a graph showing these three non-operating revenue streams since the arena started operations:

It’s TBD whether 2021 will in fact be a “hiccup” in the TIF revenue stream. For a decade it has been the one revenue source that has shown a regular increase although the pace of increase has slowed recently. Between 2017 and 2020, it has increased about $700 thousand annually, which as we will see shortly, pales alongside of upcoming debt service commitments.

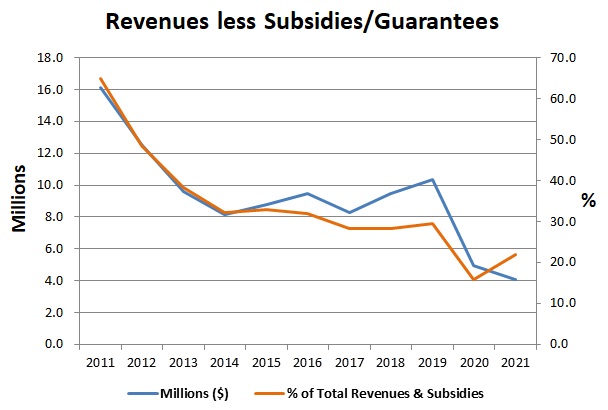

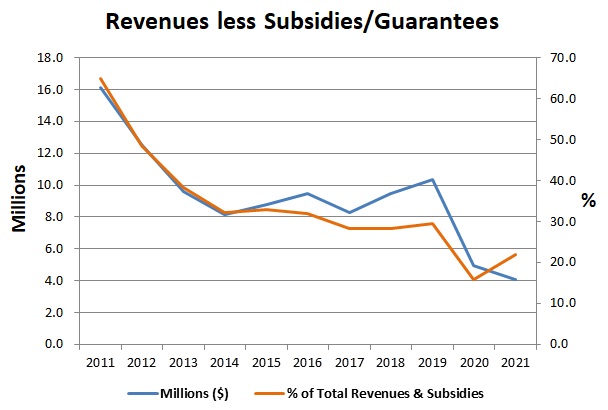

To get what I regard as a true picture of operating revenues, these non-operating revenue streams should be subtracted off of the “Revenues and Support” values reported by LAA accountants on the income statement. Over the same time period, here are those results:

One plot shows the values in millions of dollars of operating revenue, the other, showing the % of total revenues represented by the operating revenue values. Each with their own scale/axis, they show comparable results--that actual arena operations now contribute the smallest amount of revenue in arena history. Operating revenue from staging U of L events, concerts, and shows along with advertising and naming agreements has declined by 75% from $16 million in 2010 to around $4 million today. Consider that alongside of total LAA expenses in 2021 of around $32 million.

One plot shows the values in millions of dollars of operating revenue, the other, showing the % of total revenues represented by the operating revenue values. Each with their own scale/axis, they show comparable results--that actual arena operations now contribute the smallest amount of revenue in arena history. Operating revenue from staging U of L events, concerts, and shows along with advertising and naming agreements has declined by 75% from $16 million in 2010 to around $4 million today. Consider that alongside of total LAA expenses in 2021 of around $32 million.

Late in 2020, the LAA informed that Covid would significantly impair TIF revenue for 2021. The major financial impact actually occurred in 2020, but the TIF is paid to the LAA in the year following the tax relevant activity. So 2021 financials show a significant decline in TIF revenue from 2020.

I’ll first present arena revenue information followed by a forward-looking analysis of the LAA’s cash position and debt service. Future requirements from the 2017-2018 bond refinancing are spelled out in a schedule of payments much like you have with a mortgage amortization schedule. There isn’t any guesswork or estimation involved. So let’s proceed…

The majority of arena revenues in 2021 are NOT from true operating sources, “operating” in the sense of controllable or fluctuating. I used to and still occasionally refer to the place as “Bailout Arena” for this very reason. The arena was never self supporting even when it first opened its doors in late 2010. The City through its “Metro Guarantee” now contributes almost $11 million annually to arena operations. As we all recall since it happened more recently, the arena negotiated--extorted--$2.4 million annually from U of L starting in 2018 which the LAA accountants call the “U of L Guarantee.” And the TIF, of course, has been a significant and increasing revenue source until 2021’s Covid hiccup. Here’s a graph showing these three non-operating revenue streams since the arena started operations:

To get what I regard as a true picture of operating revenues, these non-operating revenue streams should be subtracted off of the “Revenues and Support” values reported by LAA accountants on the income statement. Over the same time period, here are those results: